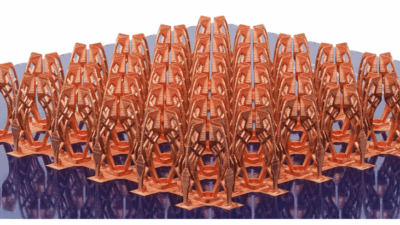

3D printing optimism seems warranted but challenges remain.

It seems like everyone has been hopping on the “wrapped” bandwagon: my first encounter with the concept was from Spotify, but at the end of the year I got offers to look back on 2025 from Discord and LinkedIn as well. If I were a more avid app user, I’m sure there would be plenty of others clamouring for my attention.

Inspired by this approach, I want to share a few of my own end-of-year stats for 2025:

- Interviews Conducted: 81

- Articles Published: 143

- Webinars Hosted: 7

- Live Events Attended: 5

- Words Written: 162,362

[With the exception of live events and webinars, these are estimations based on locally stored files.]

Of course, there are many instances where a qualitative analysis can be more useful than quantitative one, though that might be a tough pill to swallow for many engineers. (How tough precisely? Can you rate it on a scale of one to ten? Exactly how many tough pills did you have to swallow in 2025? Would you like to see a summary?)

I’d argue that the state of the additive manufacturing (AM) industry is one such case, which is why I’m continuing a tradition I started last year by reaching out to some AM experts to get their respective takes on the ups and downs of the past twelve months.

Here’s what they told me.

Positive developments in additive manufacturing in 2025

I framed the outlook for the AM industry at the start of 2025 as one of cautious optimism, and that attitude seems to have been largely vindicated, based on what I was told.

“We’ve seen solid growth in the production of medical implants through additive manufacturing as well as in energy, and these show that, when you have the right applications, the value is there,” says Bart Van der Schueren, CTO at Materialise. “That’s why we’re seeing sustainable growth in these areas.”

That sentiment is shared by Arvind Rangarajan, global head of product and strategy at HP Additive Manufacturing Solutions: “In 2025, the most significant positive development for HP AM is the double-digit growth in usage across all key segments and the clear progress toward making production-scale AM economically viable.”

The AM industry has been trying to get out from under the shadow of excess hype that accompanied 3D printing technology in its early days, particularly in the consumer market. The consensus seems to be that the best way to do that is by building a wide range of cases where the technology adds value in manufacturing, a point that Van der Schueren describes like this:

“What I’ve noticed when I look at the market is that we have been waiting many years for that one big killer application in manufacturing, but I don’t see them. What we do see is a lot of relatively smaller applications that all show their value, which is my takeaway from the past year: a growing number of real-life, valuable applications where additive makes a difference.”

Additive manufacturing challenges in 2025

Of course, 2025 wasn’t all smiles and sunshine for the AM industry. Despite the progress the technology and the business of 3D printing have made over the years, many of the same issues remain. In Rangarajan’s words:

“The biggest challenge facing the additive manufacturing industry in 2025 was not technological maturity, but the pace at which organizations could operationalize the progress that had been made. While economics, materials, and production capability advanced meaningfully, many manufacturers were still adapting their internal processes to fully integrate additive manufacturing. The design engineering community is slowly gaining confidence and leveraging AM as a true manufacturing process. However, this creates longer adoption cycles for an industry with significant growth expectations.”

Taking a wider view, Van der Schueren pointed to broader economic trends that have impacted almost every sector. “We were confronted with a lot of uncertainty this year,” he says, “And that has had a negative effect on the manufacturing industry overall. Still, there are some sectors that are really driving additive, such as the defense space, and medical—as far as we can see—didn’t suffer from uncertainties in the markets.”

On this point, Alejandro Nieto, product manager at Meltio noted that, “We have received increasing interest in our Meltio industrial metal wire-laser solutions, the Meltio Robot Cell for the defense sector, and the Meltio Engine for robotic integration to manufacture and repair 3D parts for sectors such as automotive and aerospace.”

However, Nieto also added that, “Reliability and achieving the adoption of metal wire-laser technology for direct integration into industrial production lines,” were the biggest challenges he saw in 2025.

On a recent tour of the Rivian Engineering Center, I had a chance to sit down with Fadi Abro, global automotive director for Stratasys, and I took the opportunity to ask him about the biggest changes he’d seen in the AM industry recent years. “I would say the most obvious answer is the scale,” he told me. “The underlying answer is the enthusiasm, and the willingness to make [3D printing] the default. It’s no longer, ‘Hey, I know you’re machining this today but would you want to try this printed part?’ Now it’s ‘Hey, I need this part printed.’”

What does this year hold for additive manufacturing?

Stay tuned for next week’s follow-up and, of course, a new year of 3D printing coverage on engineering.com.